What is an Invoice: A Comprehensive Guide for Businesses

In other words, it’s a bill sent along to request payment after work has been successfully rendered. Several e-invoicing standards, such as EDIFACT and UBL, have been developed around to world to facilitate adoption and efficiency. The invoice date represents the time-stamped time and date on which the goods have been billed and the transaction officially recorded. Therefore, the invoice date has essential payment information, as it dictates the bill’s credit duration and due date. This is especially crucial for entities offering credit, such as net 30, which means payment is due in 30 days.

Wave Payments Review: Pros, Cons & Features

By properly recording invoices and payments, companies can ensure that their financial records are accurate and up-to-date. Once an invoice is recorded, the payment can be recorded as a credit to the accounts payable or accounts receivable account and a debit to the cash account. This helps ensure that all payments are properly recorded and that the company’s financial records are up-to-date.

Why are invoices important?

Handling late payments can be challenging, but with the right approach, businesses can minimize the impact on their cash flow. When an invoice is past due, it means your customer or client hasn’t paid you according to the agreed-upon payment terms. Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy. Writing clear invoices that are easy to understand may help reduce the risk of an invoice becoming past due.

Taxes and Fees

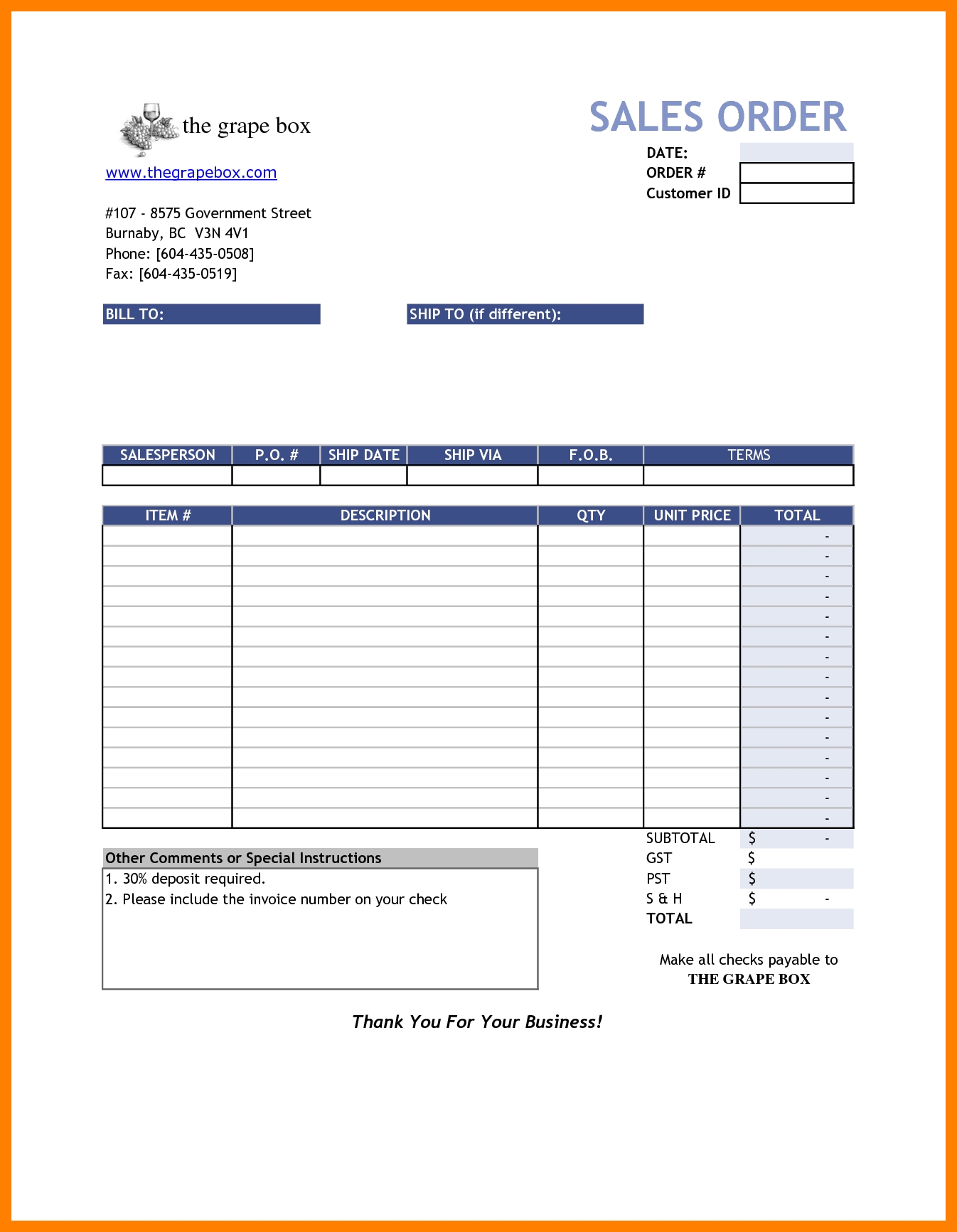

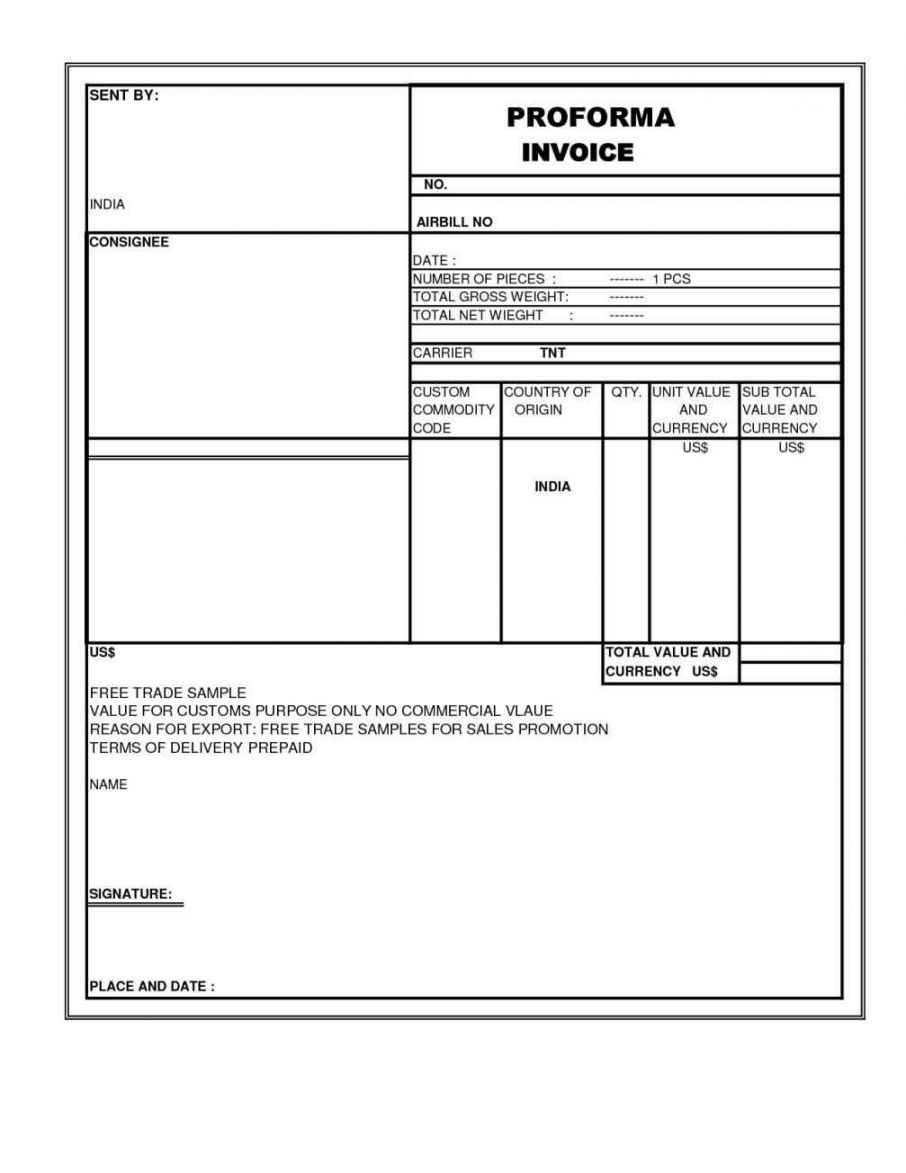

Contracts signed by both parties can act as legal documents, reduce the chance of misunderstandings about transactions, and may help speed up the payment process. Using QuickBooks, you can create electronic invoices and accept payments from one location, improving the overall transaction for your team and your clients. Pro forma invoices are sent before a formal invoice is issued to give customers an estimate of how much a product or service will cost once delivered. In accounting, accounts payable and accounts receivable are two important concepts that are closely related to invoicing. Accounts payable refers to the money that a company owes to its suppliers or vendors for goods or services received but not yet paid for. On the other hand, accounts receivable refers to the money that a company is owed by its customers for goods or services provided but not yet paid for.

- Even if the supply and invoice dates are the same, including them as separate line items are important.

- When you use the tool, it automatically saves your info, so you can create invoices more quickly in the future.

- You may find that some suppliers will require cash on delivery, while on the other hand, there may be suppliers who offer discounts in return for early payments.

- It provides documentation and a reminder to the customer that it owes the seller the amount stated on the invoice.

Understanding Invoices

You can use invoicing software to track inventory based on your invoices automatically, or you can develop a manual tracking system for invoices on your own. You can also track your payments wherever you go, at any time, and on any device including a computer, smartphone, or tablet. You can even see overdue invoices and send automatic reminders for unpaid invoices.

Is an Invoice a Bill or Receipt?

Invoices make a record of all your sales and so are helpful for bookkeeping purposes. Invoices are invoice documents that provide documentation of your business’s financial history. They track all the revenue from your business through sales and can help you gauge your profits and cash flow. Invoicing demonstrates a client’s obligation to pay for your goods or services.

It offers a direct communication line, with a quick turn around on payment for increased cash flow. With some invoicing softwares, you can even pay through a link directly in the invoice, making it an easy and straightforward process for your customers. A receipt would confirm payment, where an invoice is essentially a request for payment for products or services rendered. With this method, the invoices are sent to the customers before the project has been initiated or the product has been delivered.

On the other hand, to record an invoice in accounts receivable, the invoice amount is recorded as a debit to the accounts receivable account and a credit to the revenue account. The invoice number is a unique identifier that helps to keep track of the invoice and is essential for record-keeping purposes. The invoice date is the date on which the invoice was issued and is important for determining payment terms and due dates.

Consequently, invoices can be used when taking more formal actions, especially in cases of overdue or missing payments. No matter how good your product or service is, you will have a hard time retaining customers if your post-project handling is hasty and unprofessional. Once you develop an understanding of the invoicing process, you will be able to get paid faster, manage your accounts more effectively, and better scale your business. Invoices help protect small businesses from false lawsuits because invoices provide details of the services you provide to your clients and the timeline for completing the work.

Financial statements update in real-time, immediately reflecting shifts in your accounts receivable and bank account balances. When selling products or services, enter the invoice amount as accounts payable on the buyer’s end. Businesses send invoices to clients after they deliver a product or service.

Once the invoice is created, it should be sent to the customer as soon as possible. This can be done through email, mail, or online invoicing software. It is important to follow up with the customer how to professionally ask for payment from clients template to ensure that they received the invoice and to answer any questions they may have. An interim invoice is a type of invoice that is sent to a customer during the course of a project.