The real effects of financial reporting: Evidence and suggestions for future research

The disappointing partnership sales reflect weak underlying demand and the need to improve value and style perceptions in local markets and we are testing new partnership models to enable this. The easy thing to do today would simply be to say that these are good results, but that wouldn’t be the right thing to do. In the spirit of being positively dissatisfied, we have so much to do over this year and beyond. Despite our strong trading momentum, there is much more opportunity for future growth and that energises us.

The Quality of Financial Statements: Perspectives from the Recent Stock Market Bubble

Over 1,000 products are being upgraded and 1,400 new lines are being launched across the year, putting us even further ahead of the pack on quality credentials, and value perception is the highest it’s been in a decade. All three pillars of Oracle Health Data Intelligence have been updated to better serve stakeholders across the healthcare ecosystem. Just like learning a new language does not come easy- and you may never be fluent in that language, the language of business requires an effort to gain that basic understanding and reinforcement of the concepts through training or reading, etc.

Standard Digital

Generating financial statements regularly can assist with transparency, help track performance, and comply with regulatory requirements. Financial statements allow businesses to measure their results against industry benchmarks, peers and competitors. By focusing on financial ratios and comparing them with other companies in the same industry, can help businesses find their strengths and weaknesses, and look for possibilities to develop themselves. Periodically reviewing performance allows businesses to be more deliberate and strategic in their decision-making. The purpose of this study is to test the determinant of financial report quality and its consequences to the company values.

Optimize business spends with OfEx

It also depends on thorough and objective audits performed by independent, knowledgeable, and skeptical public accountants. Indeed, while preparers are the lynchpin of high‑quality financial reports, auditors are the key gatekeepers for those reports, protecting shareholders by ensuring that issues are promptly identified and addressed. As with other parts of the chain in financial reporting, there is both encouraging news and also some areas of concern.

- Investopedia’s Glossary of Terms provides you with thousands of definitions and detailed explanations to help you understand terms related to finance, investing, and economics.

- Over the next three days, our Chief Accountant Jim Schnurr, Director of Corporation Finance Keith Higgins, and Director of Enforcement Andrew Ceresney—and members of their staffs—will address each of the topics I cover in more detail.

- Ratios such as the current ratio, debt-to-equity ratio, and return on assets provide deeper insights into financial health and operational performance.

- These factors are needed to achieve FRQ and is able to provide positive respond to the market.

Financial statement users who were able to accurately assess financial reportingquality were better positioned to avoid losses. These lapses illustrate the challengesanalysts face as well as the potential costs of failing to recognize practices thatresult in misleading or inaccurate preparation 2020 financial reports. Examples of misreporting can provide an analyst with insight into various signalsthat may indicate poor-quality financial reports. High-quality financial reporting provides information that is useful to analystsin assessing a company’s performance and prospects.

Therefore, the reported financial information should project a realistic and accurate view of the enterprise. We have seen concrete progress by companies working to make disclosures clearer and more understandable, in particular by removing redundancies or unnecessary information. In addition, several wholesale and marketplace sales opportunities have been identified which should contribute to the second half result.

A valid decision can be made if the information in the financial statements meets the quality of financial information, including being presented in an appropriate, relevant, comparable, understandable, timely and verifiable manner. In addition, the quality of financial reporting is also useful in making decisions regarding the allocation of resources owned by the company. Fulfillment of the quality of financial reporting will be able to inform the company’s ability to manage both internal and external sources of funds, and meet the right elements of accountability (Lin et al., 2016).

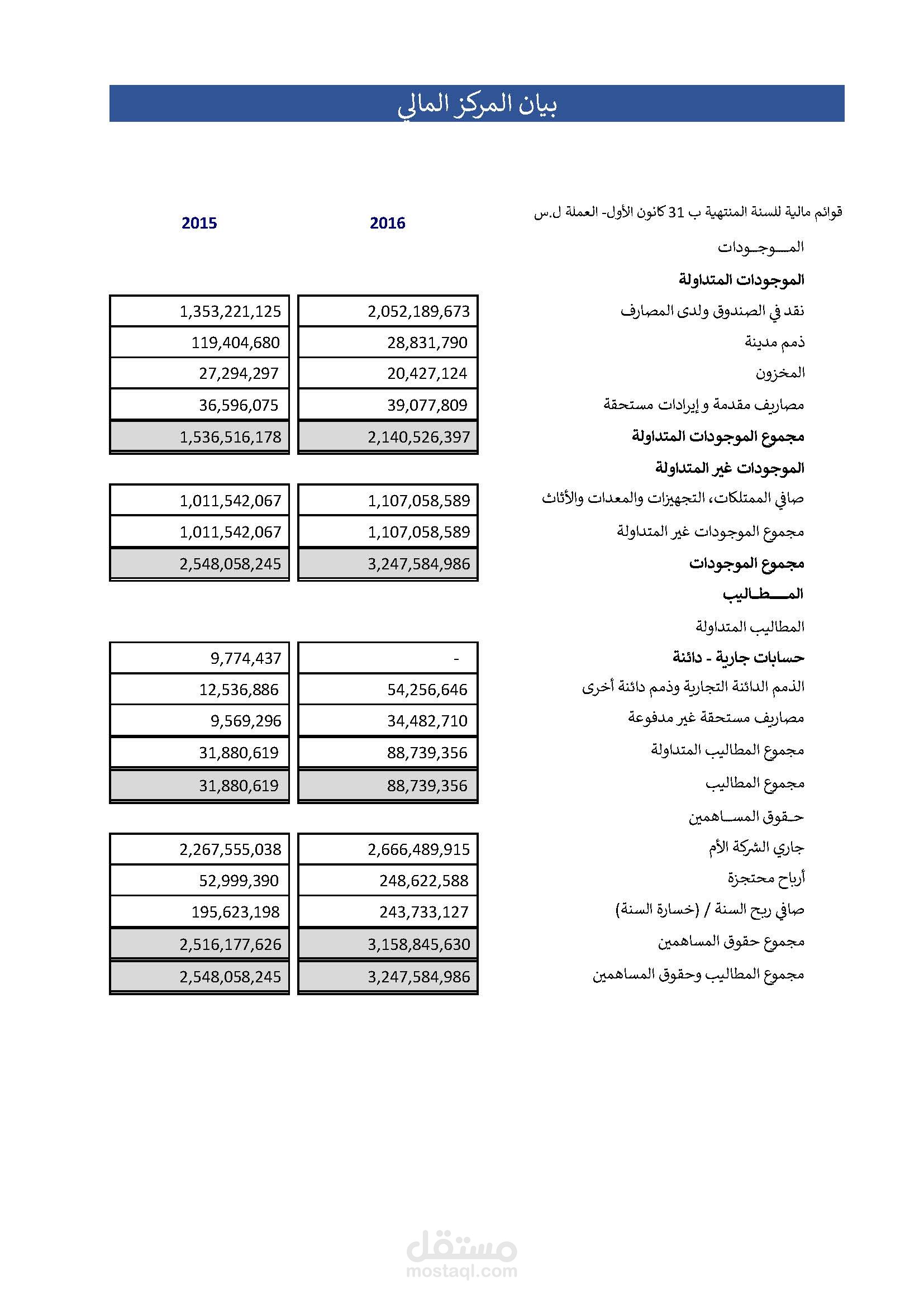

The ability to assess the quality of reported financial information can be a valuableskill. An analyst or investor who can recognize high-quality financial reporting canhave greater confidence in analysis based on those financial reports and the resultinginvestment decisions. Similarly, an analyst or investor who can recognize poor financialreporting quality early—before deficiencies become widely known—is more likely tomake profitable investment decisions or to reduce or even avoid losses. The balance sheet is a key financial statement that summarizes the financial position of a company at a given point in time by reporting the assets, liabilities and shareholders’ equity of a company. The balance sheet is one of the major financial statements – in addition to the income statement and statement of cash flows – used to evaluate the liquidity and profitability of a business. A financial statement is an official document that records the financial activities and status of a business, giving a complete description of the company’s financial activity during a predefined period.

In this respect, one of the determining factors that enhance the quality of information and reduce the information risk of corporate reports is provision of higher quality audit services (Shiri et al., 2018). This research examines the determinants of FRQ and its consequences on firm’s value (FV). Innate factors proxies from FRQ include dynamic factors (operation cycle and sales volatility), static factors (FS and FA) and institution risk factors (leverage). The results found that innate factors from financial reporting quality (FRQ) consists of dynamic factors (operation cycle and sales volatility) as well as static factors (firm’s size, FS).

Financial reporting should be done so that the reported information is realistic, amenable to interpretation, and helps investors to make proper investment decisions. The provision of information about the financial position, performance, and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions. Low quality, not high-quality, financial reports contain information that is subjective and fabricated. High-quality reports will contain information that is relevant, complete, neutral, and accurate, thereby enabling assessment. The lowest-quality reports will, however, contain information that is subjective and fabricated. The financial reporting area will continue to be a high priority for our enforcement program.

Companies that stick with generally accepted accounting principles (GAAP) standards are said to have high quality of earnings. Companies that manipulate their earnings are said to have poor or low earnings quality. It is therefore important that these statements be prepared in a way that is easy to understand and interpret.