Invoice Guide: Definition, Examples, What to include

The invoicing process involves several steps, including creating an invoice, sending it to the customer, and recording the payment received. It is a process of creating and sending invoices to customers for goods or services provided. Invoicing helps businesses keep track of their sales and revenue, and it is also a way to communicate with customers about payment due dates and terms. In accounting, an invoice is a document that records a transaction between a vendor and a buyer, itemizing the products or services delivered and the payment terms. This document helps to keep track of sale transactions, accounts receivable, and, in some cases, sales tax that has been collected for the government.

Best Invoicing Software for Small Businesses 2024

- You can also include any invoice payment terms you cannot accept to be extra clear.

- An invoice is a document that you send to customers to request or collect payment for a good or service that has already been provided.

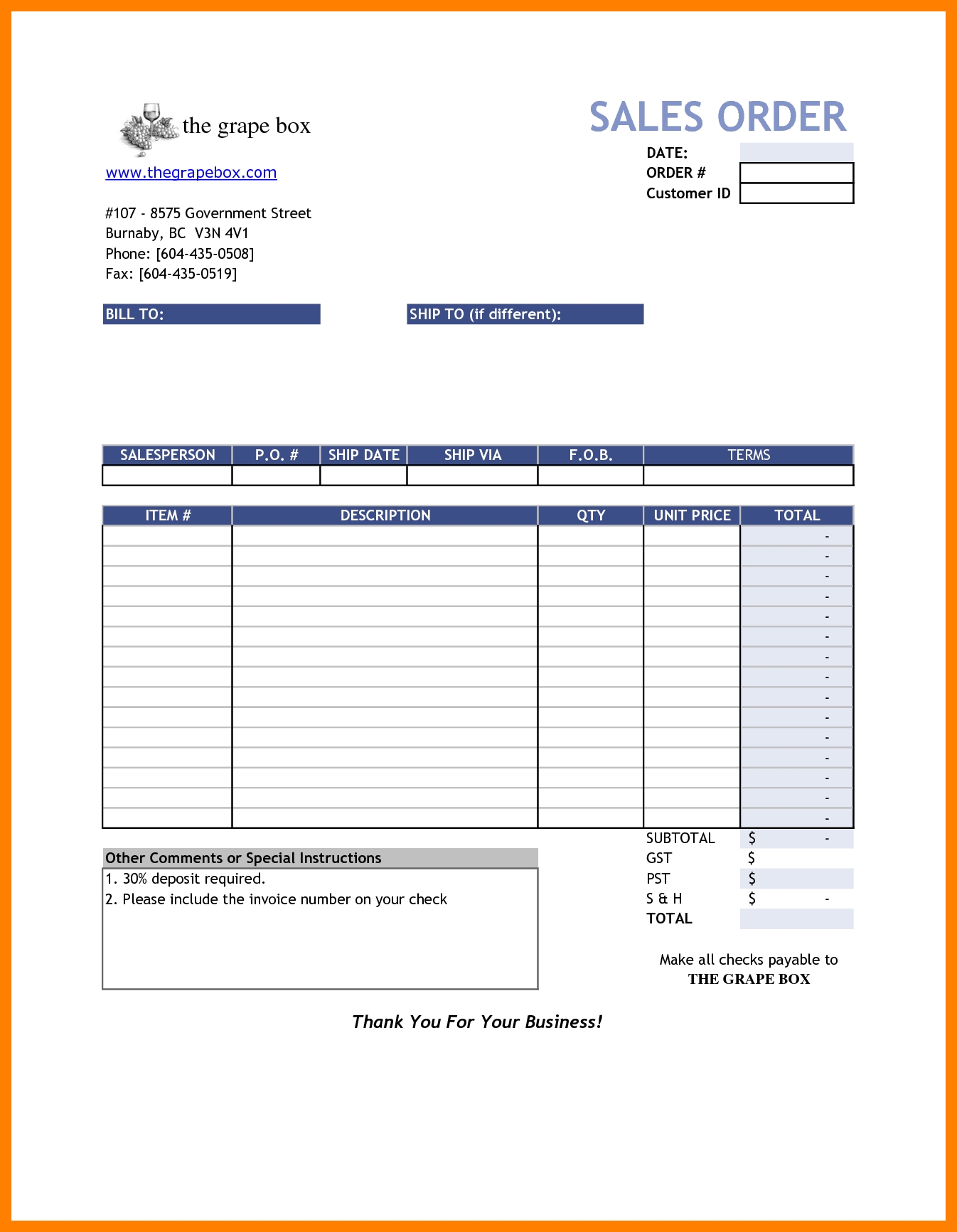

- Our sample invoice below is from Wave and shows the essential items that every invoice should possess.

- Invoices make a record of all your sales and so are helpful for bookkeeping purposes.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. You just need to fill in certain details, like per-unit price, quantity, tax rates, and discount rates, then let QuickBooks do the rest of the work for you. Follow the journey of one of history’s most influential figures in accounting, Luca Pacioli, the father of accounting. If you’re not fond of spreadsheets, you can create a .docx file with this free template.

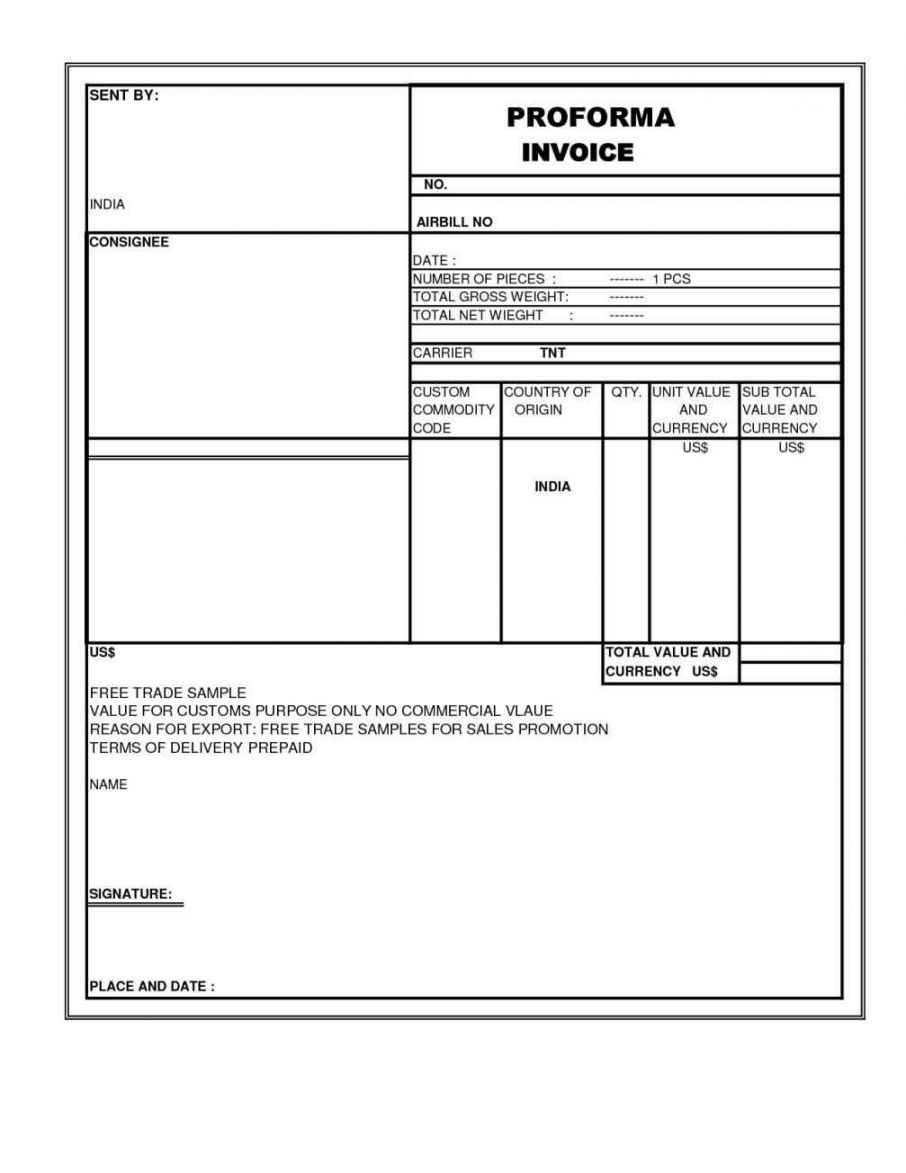

Tax rates

Our award-winning software saves you time so you can get on with running your business, while you use the smart business tools we’ve made for the world’s hardest workers. Professional invoices help you track payments and know what invoices have been paid, are pending or are overdue. These serve as proof of a sale, legally binding for both buyer and seller, so the more professional an invoice looks, the better. Recurring invoices are issued to collect recurring payments from customers and are typically issued throughout the course of an ongoing project. Proforma invoices are issued to a customer before a product or service is delivered and are used by businesses to help customers understand the scope and cost of an upcoming project.

Track Payments Anytime, Anywhere

Invoices do not contain proof that a business and its customer have agreed on the terms of payment that an invoice outlines. To reduce the chances of a disputed invoice, businesses may create contracts that outline the details of a transaction. Contracts signed by both parties can act as legal documents, reduce the chance of misunderstandings about transactions, and speed up the payment process. Define clear payment terms that outline how long your customers have to pay their invoices during the sales process.

Invoicing plays a crucial role in the legal and financial aspects of any business. It serves as a record of transactions between the buyer and the seller, acting as proof of agreed-upon terms and payment obligations. Proper invoicing practices are essential for managing accounts receivable and maintaining healthy cash flow within businesses. If you are new to this and overwhelmed about handling invoices and payments, don’t worry!

These elements are essential for both the business and the client, as they provide a clear record of the transaction and help to avoid any misunderstandings or disputes. A recurring invoice is a type of invoice that is sent to a customer on a regular basis, such as monthly or quarterly. This type of invoice is used for services that are provided on an ongoing basis, such as subscription-based services or maintenance contracts.

Once your source document is complete, and you date the invoice accordingly, you’ll have to decide how to send invoices to your customers. Many businesses used to provide their invoices to clients in person or through the mail. But now, the optimal method of sending out these documents is through email or other online services. An invoice is a document outlining the exchange of the seller’s product or service for the buyer’s payment. The term “invoice” is commonly used interchangeably with “receipt.” Essentially, they serve the same purpose – to document the price and terms of a sale or exchange of service.

The invoice date indicates the time and date when the supplier recorded the transaction and billed the client. The invoice date is a crucial piece of information, as it dictates the payment due date and credit duration. A purchase order is sent by a customer to a vendor, requesting goods or services.

A past due invoice includes all the information that a normal invoice has, plus any extra late fee charges. An invoice ID, also known as an invoice number, is a unique number assigned to each invoice generated by a company, business, or individual. Invoice numbers are essential for the tracking of invoices, and they allow invoices to be referenced and located easily in the future when dealing with clients and potential audits. Invoices have a range of purposes, but they generally boil down to five main roles in business. Those include payment tracking, maintaining records, tax filing, legal protection, and business analytics.

Interim invoices are issued when a large project is billed across multiple payments, and are sent to customers as progress payments against a project come due. Many types of accounting software let you fill out an invoice template. Some will even let you email the invoice from within the app to streamline the process. double declining balance method ddb formula calculator This approach only really makes sense if you already use the same software for your regular accounting needs. Otherwise, an invoicing software—such as FreshBooks—may be a better choice. With this method, you can use a software template—in Microsoft Word or Excel, for example—each time you send an invoice.

Invoices have traditionally been issued as paper documents, but are increasingly issued in an electronic format, which can be sent as an email. Some invoices come with a “pay now” option, allowing customers to use a variety of payment types to make an immediate payment. The “pay now” option can greatly reduce the collection time experienced by a seller. Invoicing software helps your customer relationships reach a new level. Good invoicing software includes CRM support and a customer portal for customers to track their transactions or make payments online. When invoicing for products or services that include shipping or handling charges, it’s essential to provide a clear, itemized list detailing the costs.